Introduction to Financial Planning

Financial planning is a critical aspect of personal finance, as it helps individuals and families understand their financial situation and develop a roadmap for achieving their financial goals.

However, with so many different professionals claiming to offer financial planning services, it can be challenging to determine who to turn to for help. Should you find a financial advisor or a financial planner?

Unfortunately, with the exception of Quebec, the titles of financial planner and financial advisor are not well protected in Canada, meaning that anyone can call themselves a financial planner or financial advisor without any formal qualifications or training. This lack of regulation can make it difficult for individuals to determine who is truly qualified to provide financial planning services.

The Importance of Choosing the Right Financial Advisor or Financial Planner

One issue is that the vast majority of financial advisors and financial planners in Canada are not actually doing true financial planning.

Instead, they are more accurately described as financial product salespersons, mutual fund brokers, or insurance agents. Their primary focus is selling financial products, such as mutual funds or insurance policies, rather than providing comprehensive financial planning services.

This means that many individuals who believe they are receiving financial planning services may not actually be getting the full range of services they need to achieve their financial goals.

Understanding the Designations and Lack of Regulation in Canada

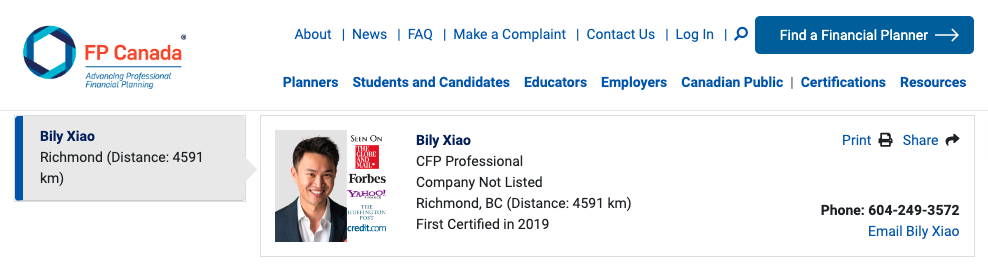

To ensure that you’re working with someone who is truly qualified to provide financial planning services, it’s important to look for a financial advisor or financial planner who holds a CFP (Certified Financial Planner) designation.

The CFP designation is the most widely recognized certification in the financial planning industry and requires that the professional complete a comprehensive program of study, pass a rigorous exam, and meet stringent ethical and professional standards.

You can confirm if your financial advisor/planner is a CFP with a quick search on FP Canada’s CFP directory: https://www.fpcanada.ca/findaplanner

Differentiating Between True Financial Planning and Product Sales

However, even having a CFP designation is not enough to guarantee that you’re working with someone who is truly qualified to provide financial planning services. It’s also essential to understand the scope of services being provided, the financial planner’s process for financial planning, and their business model and compensation model.

Some financial advisors and financial planners are only compensated when you buy a financial product, while others are commission-based. Still, others are on a salary and bonus structure, and their success in the company is measured by production and volume of accounts opened.

Understanding how your financial advisor or financial planner is compensated can help you understand any potential biases or conflicts of interest they may have.

Considerations for Business Model and Compensation Structure

For example, if a financial advisor or financial planner is only compensated when you buy a financial product, they may be more inclined to recommend a particular product, even if it’s not the best fit for your financial needs and goals.

If they’re commission-based, they may be more focused on selling a certain type of product that provides the highest commission, rather than the best solution for your financial situation.

On the other hand, if they are on a salary and bonus structure, their focus may be on meeting production and volume targets, which may not align with your financial goals and needs.

At Mobius Planning, our priority is always our clients’ financial well-being. We charge a fully transparent fee directly for our services. Our fee-based compensation structure ensures that our clients receive objective advice that is aligned and tailored to their unique needs and goals.

Expertise and Experience of the Financial Advisor or Financial Planner

Another factor to consider when choosing a financial advisor or financial planner is their experience and expertise. Different financial professionals may have different areas of specialization, such as investments, insurance, money coaching, retirement planning, planning for business owners, and estate planning.

It’s important to choose a financial advisor or financial planner who has the experience and expertise to meet your specific situation and needs.

Investment Philosophy and Approach

You can also consider the financial advisor’s or financial planner’s investment philosophy and approach. For example, some financial professionals take a more conservative approach to investing, focusing on low-risk, low-return investments, while others may take a more aggressive approach, focusing on higher-risk, higher-return investments.

Are they using mutual funds, or stocks and bonds, or ETFs or alternative asset classes? Are they investing in oil & gas companies and are you personally ok with that? It’s essential to choose a financial advisor or financial planner whose investment philosophy aligns with your own risk tolerance and financial goals.

Level of Support and Guidance

Another important factor to consider when choosing a financial advisor or financial planner is the level of support and guidance they provide. Some financial advisors and financial planners may take a hands-off approach, simply providing recommendations and leaving the implementation of the plan to you.

Others, like us, may take a more hands-on approach, helping you to implement the financial plan and providing ongoing adjustment and guidance along the way. The level of support and guidance you need will depend on your financial goals, investment experience, and personal preferences.

Building a Personal Relationship with Your Financial Advisor or Financial Planner

In addition to the above factors, it’s important to choose a financial advisor or financial planner who you feel comfortable working with. You are sharing incredibly personal life and financial information, after all. This means finding someone who you can trust, who communicates in a way you understand, and who is responsive to your needs and concerns. Building a strong relationship with your financial advisor or financial planner is critical to the success of your financial plan, as you will need to be able to rely on their expertise and guidance as you progress toward your financial goals.

Choosing the right financial advisor or financial planner is an incredibly important decision that will have a significant impact on your financial future. By considering factors such as scope of service, qualifications, experience, investment philosophy, level of support and guidance, personal compatibility, as well as their business model and compensation structure, you can increase your chances of finding a financial advisor or financial planner who can help you achieve your financial goals. Whether you’re just starting out on your financial journey or are well into retirement, having a comprehensive financial plan in place can help you achieve financial security and peace of mind.